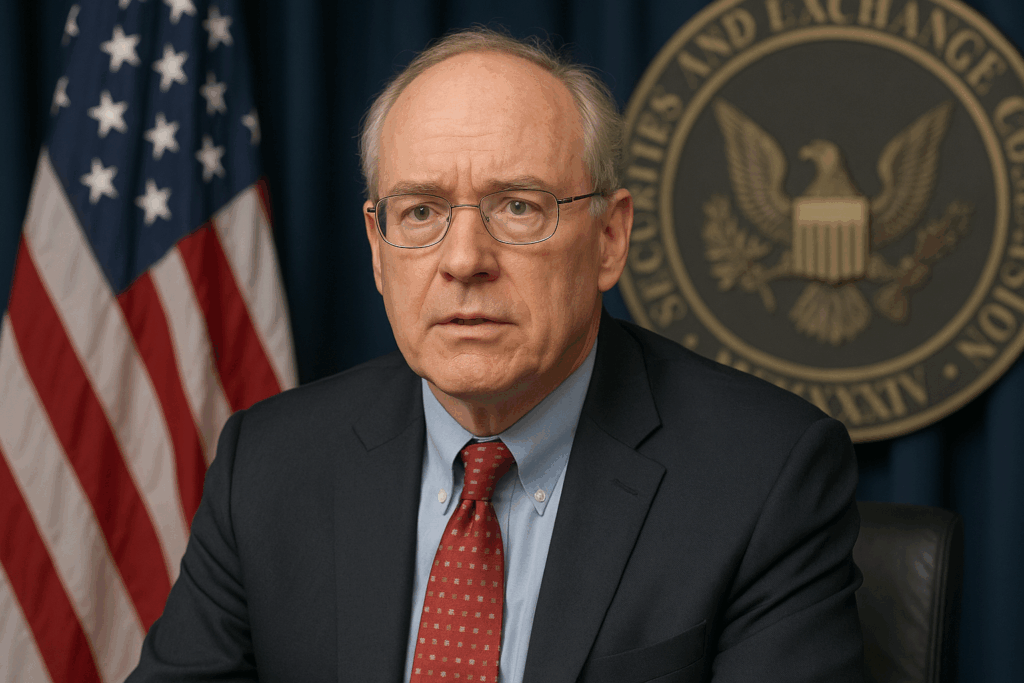

Washington, September 4, 2025 — U.S. Securities and Exchange Commission (SEC) Chair Paul S. Atkins has made it clear that clarifying crypto rules will be a central focus of the agency’s Spring 2025 Unified Agenda of Regulatory and Deregulatory Actions. Alongside this, Atkins is pushing for broader deregulatory reforms aimed at reducing compliance burdens, modernizing outdated systems, and stimulating capital formation in U.S. financial markets.

Atkins emphasized that the crypto sector deserves “clear, consistent, and fair rules of the road,” highlighting a shift away from the enforcement-heavy approach of his predecessor Gary Gensler. Instead, the SEC under Atkins is focusing on rulemaking, integration with traditional finance, and fostering innovation.

Key Elements of the Spring 2025 Agenda

1. Clarifying Crypto Regulations

For years, the crypto industry has called for clarity around whether digital assets qualify as securities, commodities, or an entirely new asset class. Atkins’ agenda aims to address this by:

- Proposing safe harbor provisions for token issuers to innovate while complying with basic disclosure and investor-protection standards.

- Clarifying the custody framework for digital assets, including how banks, exchanges, and broker-dealers can securely hold crypto.

- Establishing definitions around staking, stablecoins, and tokenized securities, three areas of rapid growth but regulatory uncertainty.

This clarity is expected to help startups, institutional investors, and corporate treasuries operate with greater confidence, potentially boosting adoption.

2. Mainstream Trading Frameworks

The SEC is considering amendments to allow certain crypto assets to be listed and traded on national securities exchanges and alternative trading systems (ATSs). This move would:

- Bridge the gap between crypto and traditional equity markets.

- Improve liquidity and transparency in crypto trading.

- Enable institutional players to access digital assets within regulated environments, reducing reliance on offshore exchanges.

Market analysts suggest this could accelerate the integration of crypto into ETFs, pension funds, and mainstream trading platforms, further legitimizing the sector.

3. Advancing Deregulatory Reforms

Beyond crypto, Atkins is focused on modernizing outdated compliance frameworks:

- Disclosure requirements: Simplifying how public companies report financials, cutting redundant paperwork.

- Private markets access: Expanding investor eligibility for private offerings, allowing more retail participation.

- Capital formation: Streamlining rules for small businesses and startups to raise funds more efficiently.

These reforms aim to unlock capital, reduce bureaucratic bottlenecks, and maintain U.S. competitiveness as other regions, including the EU and Asia, race ahead in adopting digital finance innovations.

4. Reevaluating the Consolidated Audit Trail (CAT)

The Consolidated Audit Trail, a system designed to monitor all U.S. equities and options trades, has faced backlash over:

- High operating costs.

- Risks of sensitive data leaks.

- Recent court rulings questioning its constitutionality.

Atkins’ agenda calls for a public consultation process to determine whether CAT should be restructured or scaled back. This could significantly alter how U.S. markets are monitored for fraud and manipulation.

5. Regulatory Reset

Perhaps the clearest departure from previous leadership is the withdrawal of several proposed rulemakings carried over from the Gensler era. Many of these were considered overly restrictive, particularly toward crypto and fintech firms. By removing them, Atkins is signaling:

- A lighter-touch approach to innovation.

- A preference for market-driven solutions over rigid enforcement.

- A “reset” in how the SEC engages with the digital asset ecosystem.

Broader Context: From Enforcement to Innovation

Under Gary Gensler, the SEC filed high-profile lawsuits against major crypto firms, creating a climate of uncertainty and driving many projects offshore. By contrast, Atkins has already:

- Paused or dropped several enforcement cases.

- Launched “Project Crypto”, a dedicated initiative to create a modern regulatory framework tailored to digital assets.

- Engaged directly with industry leaders, institutional investors, and policymakers to shape rules that balance innovation with investor protection.

This marks a strategic pivot toward fostering U.S. leadership in blockchain and digital finance, rather than allowing innovation to migrate to jurisdictions with clearer regulatory frameworks.

Market Implications

- For Crypto Firms: Startups and exchanges may gain a clearer pathway to operate legally in the U.S., potentially sparking a wave of new token launches, corporate integrations, and institutional adoption.

- For Investors: With rules clarified, institutional money — pension funds, insurers, hedge funds — could enter the crypto sector at a much larger scale.

- For Traditional Finance: Deregulatory reforms may lower costs for companies and open new capital formation avenues, potentially boosting equity markets.

- For Regulators Globally: Atkins’ approach could serve as a template for other jurisdictions grappling with the balance between innovation and regulation.

Summary Table

| Focus Area | Key Objective |

|---|---|

| Crypto Clarity | Define issuance, custody, and trading rules; safe harbors |

| Market Integration | Enable crypto to trade on regulated exchanges and ATSs |

| Deregulatory Reforms | Ease compliance burdens, modernize disclosures, boost funding |

| CAT Reevaluation | Address cost and data risks through public consultation |

| Regulatory Reset | Withdraw outdated, enforcement-heavy proposals |

Conclusion

With the Spring 2025 agenda, SEC Chair Paul S. Atkins is signaling a new regulatory era — one that emphasizes clarity over confusion, innovation over restriction, and modernization over outdated systems. If successfully implemented, these reforms could not only stabilize the U.S. crypto market but also position America at the forefront of the global digital finance revolution.