A Bitcoin-Treasury Corporate Strategy

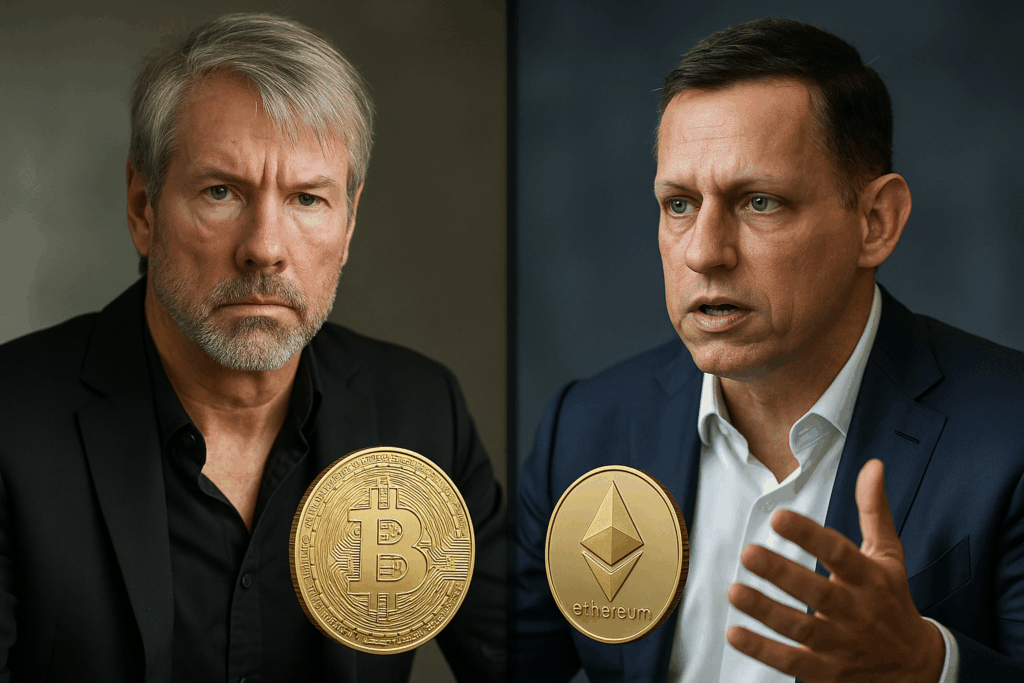

Michael Saylor—co-founder and executive chairman of the company now rebranded as Strategy (formerly MicroStrategy)—has transformed the firm into the world’s largest corporate holder of Bitcoin. This reflects his belief in Bitcoin as a superior reserve asset compared to cash or gold.

Unprecedented Accumulation

The pace of accumulation is eye-popping:

- As of late August 2025, Strategy held approximately 632,457 BTC, acquired for about $46.5 billion, averaging $73,527 per coin.

- Other data confirms holdings near 636,505 BTC valued around $70.8 billion, with an average cost near $73,765.

The Financial Engine Behind the Strategy

Rather than relying on existing cash reserves, Strategy has raised over $40 billion via stock and bond issuances—including $27 billion from equity and $13.8 billion from debt—to fund Bitcoin purchases. While highly leveraged, this approach has paid off: Saylor’s net worth surged nearly $1 billion in 2025, currently estimated at around $7.37 billion, placing him among the world’s richest entrepreneurs.

Risk and Reward

This aggressive approach positions Strategy as a sort of leveraged Bitcoin proxy—akin to a spot leveraged ETF—but also amplifies downside risk during crypto pullbacks. Analysts note that despite Bitcoin’s potential upside, Strategy’s valuation may command a premium, offering around $0.59 in BTC per invested dollar, depending on market conditions and volatility.

Peter Thiel: Strategic, Indirect Ethereum Exposure

A Venture-Style Play into Ethereum

Peter Thiel approaches crypto from a venture-capital lens. Rather than buying Ether directly, his Founders Fund has taken significant equity stakes in companies that pivoted to become Ethereum treasury vehicles—most notably ETHZilla and BitMine Immersion Technologies.

ETHZilla – Biotech Turned Ethereum Holder

- ETHZilla was formerly the Nasdaq-listed biotech firm 180 Life Sciences. Post-rebranding, it shifted focus to buying Ether. Thiel and his entities now own 7.5% of ETHZilla.

- Following the investment, ETHZilla’s stock jumped over 200%, showcasing investor enthusiasm.

- Most recently, ETHZilla injected $100 million worth of ETH into the liquid restaking protocol EtherFi, broadening its DeFi strategy.

BitMine – Mining Company Repositioned for Ethereum

- Thiel’s fund also holds about 9.1% of BitMine Immersion, a former Bitcoin miner now focused on building an Ethereum treasury via a $250 million raise.

- BitMine now holds over 163,000 ETH (valued at $500M+), and its stock has surged by 15–30%, reflecting bullish investor sentiment.

Institutional Momentum and Broader Adoption

These moves coincide with a broader institutional shift: by August 2025, corporate treasuries collectively held $17.6 billion in Ethereum, reflecting growing faith in Ethereum’s programmable finance ecosystem and adoption among institutional players.

Comparison Table: Saylor vs. Thiel

| Aspect | Michael Saylor / Strategy | Peter Thiel / Founders Fund |

|---|---|---|

| Asset Focus | Direct, large-scale Bitcoin accumulation | Indirect, diversified exposure via Ethereum equities |

| Strategy Basis | Treasury asset, inflation hedge, high conviction | Equity stakes in companies repositioned to hold ETH |

| Funding Model | Raised capital via equity/debt offerings | Traditional VC-style investment in public equities |

| Risk Profile | High leverage, high volatility | Exposure to company execution, DeFi utility, market sentiment |

| Upside Dynamics | Pure Bitcoin price appreciation | Equity growth + Ethereum utility capture |

| Institutional Fit | Bitcoin treasury model | Emerging trend in Ethereum treasury adoption |

Final Thoughts

- Michael Saylor has built an audacious and concentrated hedge on Bitcoin—transforming his company into a near-single-asset treasury. The model has delivered massive gains, albeit at the expense of balance-sheet stability.

- Peter Thiel, by contrast, is taking a more nuanced and venture-savvy role—using traditional investment vehicles to capture upside exposure to Ethereum’s ecosystem. He’s bullish on decentralized finance, but playing it through selective corporate exposure.

Together, these strategies illustrate two very different corporate paths to crypto exposure—one rooted in scale and leverage, the other in flexibility and diversified institutional positioning.