For the past decade, Bitcoin has consistently dominated the crypto market as both the largest digital asset by market capitalization and the most actively traded token on centralized exchanges.

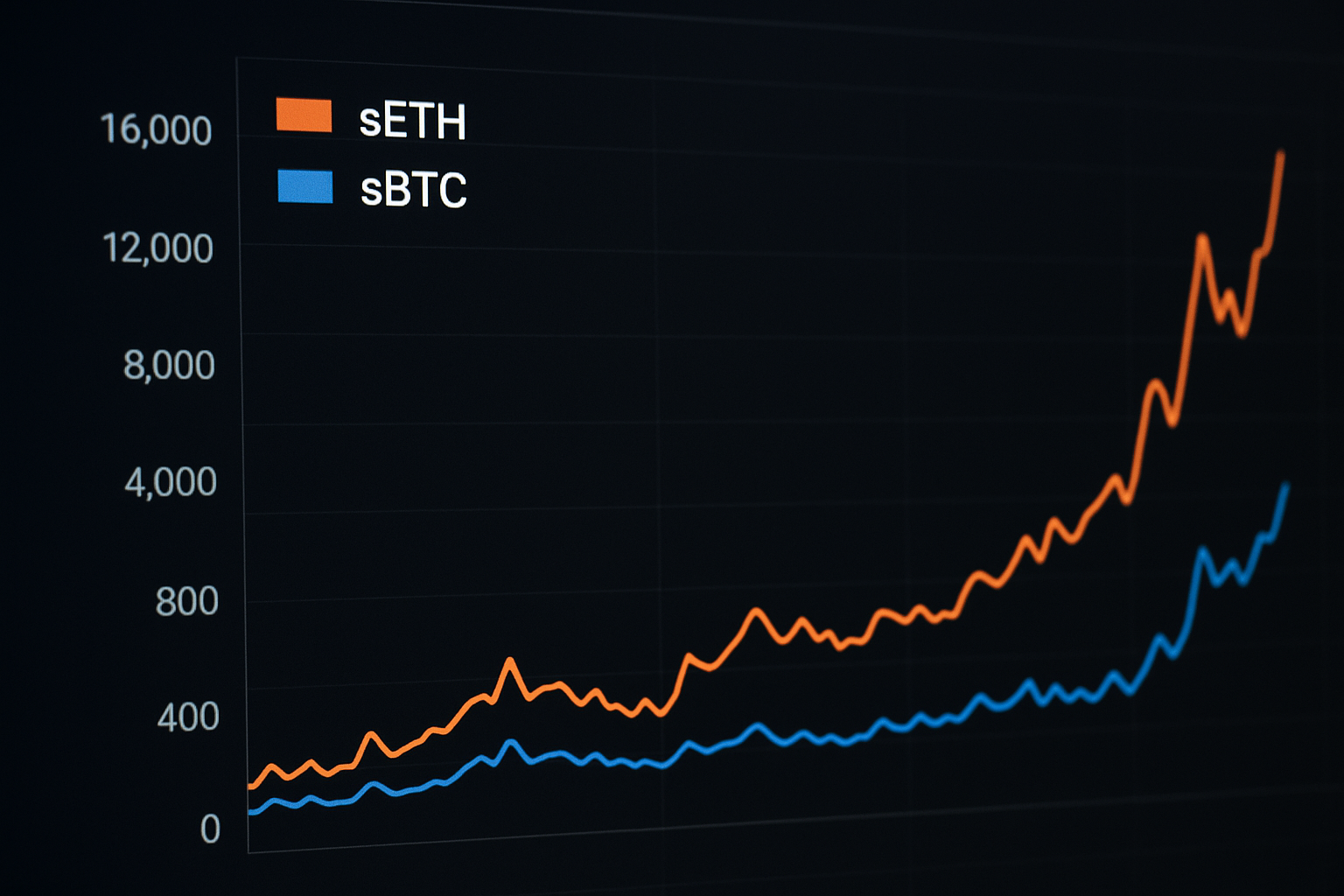

Even when derivatives and newer products entered the scene, Bitcoin’s liquidity leadership was rarely questioned. However, new data from Kaiko reveals a significant shift: staked Ethereum (sETH) spot trading volume on centralized exchanges (CEXs) has surpassed staked Bitcoin (sBTC) for the first time in five years. This development is more than just a statistical anomaly — it represents a deep transformation in how investors are engaging with digital assets and signals Ethereum’s growing influence on market structure.

The Numbers Behind the Shift

Kaiko’s report highlights that trading activity in sETH has been steadily rising over the past two years, but 2025 marks the first time its volumes overtook sBTC on CEXs. Spot trading volume, a key indicator of liquidity and investor interest, reflects how actively an asset is exchanged in the open market. Historically, sBTC’s volumes have dwarfed its counterparts due to Bitcoin’s dominant position. The fact that sETH has crossed this threshold underscores Ethereum’s expanding role in both retail and institutional portfolios.

What makes this milestone striking is that Bitcoin has maintained a higher market capitalization and broader recognition. Despite this, exchange participants are increasingly favoring sETH, driven by the mechanics of staking, the flexibility of liquid staking derivatives (LSDs), and Ethereum’s central role in decentralized finance.

Why sETH is Gaining Ground

Ethereum’s transition to proof-of-stake (PoS) in 2022, commonly referred to as the Merge, fundamentally changed its monetary and technical dynamics. Unlike Bitcoin, which operates on proof-of-work (PoW), Ethereum now incentivizes network participants through staking rewards. Staked ETH earns a yield that is directly tied to the security and functionality of the network.

The introduction of liquid staking — through platforms like Lido, Rocket Pool, and others — created derivatives such as sETH, which represent staked ETH while remaining tradable. This solved one of the major challenges of staking: illiquidity. Investors can now stake ETH, earn rewards, and still trade their staked positions on exchanges. This flexibility has drawn immense interest from both retail traders seeking yield and institutions searching for efficient capital deployment strategies.

By comparison, sBTC does not offer similar organic yield opportunities. While tokenized or wrapped versions of Bitcoin exist, they largely serve as portability solutions rather than yield-generating assets. This fundamental difference is a primary driver behind the shift in trading activity.

Institutional Appetite for Yield

Institutional investors have played a critical role in tipping the balance toward sETH. With the rise of tokenized finance and structured crypto products, yield-bearing assets have become increasingly attractive. sETH provides exposure to Ethereum’s underlying value while also offering a predictable yield stream, something that appeals to funds looking for more than just price speculation.

Recent developments, including the approval of spot Ethereum ETFs in major markets and growing institutional adoption of staking services, have further fueled interest. Liquidity providers and asset managers are now integrating sETH into broader strategies, adding another layer of demand that has pushed exchange volumes higher.

Impact of Ethereum’s Expanding Use Cases

Another factor driving sETH’s popularity is Ethereum’s role as the foundational layer for decentralized finance (DeFi), NFTs, and tokenization projects. While Bitcoin is primarily viewed as “digital gold,” Ethereum has positioned itself as programmable money. The utility of ETH — and by extension sETH — spans beyond investment into functional participation in decentralized applications, lending protocols, and even real-world asset tokenization.

This ecosystem-driven demand creates a reinforcing cycle: as more assets and applications are built on Ethereum, the need for staking grows, and with it, the trading of liquid staking tokens like sETH. This multi-layered utility is not something Bitcoin can replicate at present, giving Ethereum a unique advantage in liquidity markets.

What This Means for Bitcoin

It’s important to note that Bitcoin is not losing relevance. It remains the most secure and recognized cryptocurrency, with unmatched brand power as a global store of value. However, the surpassing of sBTC volumes by sETH highlights that market dynamics are no longer one-dimensional. Investors now look at digital assets through multiple lenses — store of value, yield, programmability, and liquidity — and Ethereum is capturing categories that Bitcoin does not address.

Some analysts caution that Bitcoin could face longer-term challenges if it doesn’t develop new ways to remain relevant in yield-focused markets. Efforts like wrapped Bitcoin on Ethereum and other tokenized versions show attempts to extend Bitcoin’s utility, but they have not matched the success of Ethereum’s staking economy.

Market Implications

This development carries several broader implications for the industry:

- Shift in Liquidity Hubs – Centralized exchanges are adapting to meet the growing demand for sETH trading pairs, signaling that liquidity concentration may increasingly lean toward Ethereum-linked assets.

- Changing Investor Priorities – Yield and programmability are becoming more important than pure store-of-value narratives. This indicates a maturing investor base that is exploring diversified strategies.

- DeFi Spillover Effects – Increased sETH trading on CEXs often translates to more liquidity in DeFi, as these tokens bridge the gap between centralized and decentralized markets.

- Institutional Legitimacy – Surging volumes in sETH highlight institutional validation of Ethereum staking as a sustainable and reliable yield mechanism, strengthening Ethereum’s position as a financial layer of the future.

Looking Ahead

The surpassing of sBTC by sETH on centralized exchanges could mark the beginning of a long-term trend rather than a short-lived anomaly. If Ethereum continues to expand its staking ecosystem, and if regulatory frameworks in major jurisdictions remain favorable toward staking-based products, sETH could solidify its role as the second pillar of global crypto liquidity, rivaling Bitcoin in ways previously unimagined.

For Bitcoin, the challenge will be maintaining dominance as the market diversifies. While Bitcoin will likely remain unmatched as a non-sovereign store of value, Ethereum’s staking economy is carving out an entirely new arena of competition — one defined not by scarcity, but by yield, flexibility, and utility.

Conclusion

Kaiko’s report is more than a headline — it is a reflection of how far Ethereum has come since its proof-of-stake upgrade. For the first time in five years, Bitcoin’s dominance in spot volumes on CEXs has been challenged, and Ethereum’s staking model has taken the lead. Whether this marks a permanent realignment or a temporary shift, one thing is clear: the future of digital assets is no longer built around a single narrative, but a multi-asset ecosystem where both Bitcoin and Ethereum play critical yet distinct roles.