Introduction

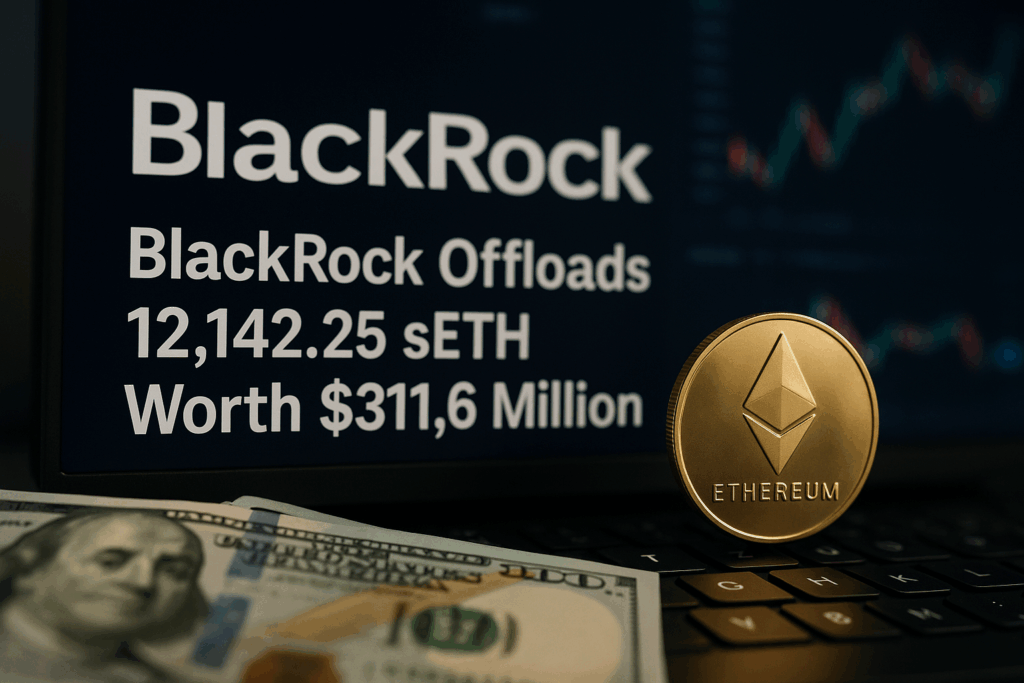

BlackRock, the world’s largest asset manager with over $10 trillion under management, continues to make waves in the digital asset space. In its latest move, the firm has reportedly offloaded 12,142.25 SETH tokens, valued at approximately $311.6 million. This transaction adds another layer of intrigue to BlackRock’s evolving strategy in crypto markets, as the firm has been both aggressively acquiring and selectively selling Ethereum and related assets throughout 2025.

Understanding SETH

While Ethereum (ETH) remains the second-largest cryptocurrency by market capitalization, SETH refers to a structured or synthetic Ethereum-linked asset. It is often used in institutional portfolios to mirror ETH exposure while offering tax or regulatory advantages. These assets can be packaged as derivatives, ETF-linked holdings, or tokenized instruments, designed to give institutional investors flexible exposure to Ethereum without holding ETH directly.

Thus, BlackRock’s sale of 12,142.25 SETH worth $311.6 million suggests a significant rebalancing of its crypto exposure, particularly within Ethereum-linked products.

BlackRock’s Broader Ethereum Strategy in 2025

The sale of SETH must be viewed in the larger context of BlackRock’s activities this year. In 2025, the asset manager has been one of the most influential players in driving institutional adoption of crypto:

- Massive ETH Accumulation in Mid-2025

- Between July and early August, BlackRock added more than 1 million ETH to its holdings, worth over $3.7 billion at the time.

- This brought its total Ethereum exposure to around 2.8 million ETH, valued at over $10 billion.

- Diversified Crypto Portfolio

- BlackRock has balanced its portfolio between Bitcoin and Ethereum, frequently rotating positions.

- In recent months, it sold over $560 million worth of Bitcoin while purchasing around $95 million of Ethereum, signaling confidence in ETH’s long-term potential.

- Strategic Re-entries After Market Dips

- Following a market sell-off in early August, BlackRock bought an additional 9,251.59 ETH (

$34.2 million) and 363 BTC ($41.9 million). - Such timing suggests BlackRock is actively trading around volatility, rather than maintaining a purely passive strategy.

- Following a market sell-off in early August, BlackRock bought an additional 9,251.59 ETH (

- Profit-Taking Moves

- The firm has also been spotted selling 19,504 ETH in a transaction valued at around $82.7 million.

- These sales likely represent profit-taking opportunities, as ETH prices rallied following earlier BlackRock purchases.

Why This Sale Matters

The 12,142.25 SETH sale worth $311.6 million is significant for several reasons:

- Portfolio Rebalancing: Institutions often sell portions of their holdings to maintain targeted portfolio allocations. BlackRock’s move could reflect an internal decision to keep Ethereum exposure within a certain range.

- Profit Realization: With Ethereum’s price rallying in recent months, BlackRock may be capturing gains while retaining a large core position.

- Market Signal: Given BlackRock’s size and influence, any large transaction sends signals to the market. A sale of this magnitude may cause short-term bearish pressure, but long-term bullish implications remain if BlackRock continues accumulating ETH elsewhere.

- ETF Implications: As BlackRock’s Ethereum ETF products grow, sales like these may also be tied to redemptions or adjustments linked to investor demand.

Impact on Ethereum Market

- Price Volatility: Ethereum markets are sensitive to large institutional moves. A $311.6 million offload is not small, and traders will be watching closely for its impact on price stability.

- Liquidity Absorption: Unlike retail-driven trades, institutional transactions of this size are typically spread across OTC desks or dark pools to minimize slippage. This suggests the broader market may absorb the sale without dramatic disruption.

- Investor Sentiment: Despite the sale, BlackRock’s overall posture remains heavily invested in Ethereum. Its net accumulation throughout 2025 far outweighs these selective sales.

Conclusion

The offloading of 12,142.25 SETH worth $311.6 million by BlackRock marks another tactical adjustment in the firm’s crypto strategy. While it may raise short-term questions about Ethereum’s price direction, the broader picture shows BlackRock continues to hold billions in ETH exposure, positioning itself as one of the largest institutional players in the Ethereum ecosystem.

This move should be viewed not as a retreat but as a strategic recalibration—balancing gains, managing risk, and ensuring flexibility in an asset class that is rapidly evolving.