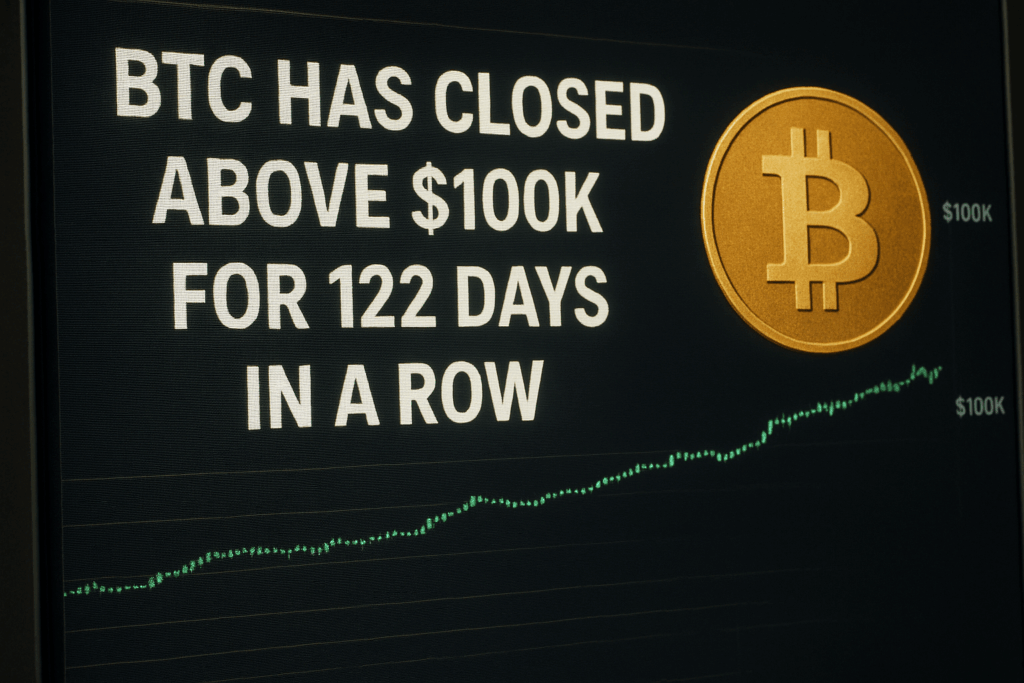

Bitcoin, the world’s first and largest cryptocurrency, has now achieved a milestone that was once considered unimaginable: staying above the $100,000 price mark for 122 consecutive days. This achievement is not just a statistical record but a profound turning point in the story of digital money. What we are witnessing is Bitcoin stepping fully into its role as a global financial asset, not merely an experiment in decentralized money.

For context, Bitcoin’s history has been defined by cycles of boom and bust. Each cycle would typically involve rapid surges past psychological barriers — $1,000, $10,000, $20,000, $50,000 — followed by painful corrections. The $100,000 mark, however, is different. Unlike previous cycles where breakouts quickly collapsed under speculative pressure, Bitcoin has sustained this level for over four months. This extended consolidation suggests that Bitcoin has entered a new phase of stability and maturity, underpinned by institutional adoption, macroeconomic realities, and evolving investor psychology.

Why This Milestone Matters

Crossing a round number in markets often carries psychological weight. For Bitcoin, $100,000 represents more than a symbolic barrier — it signifies legitimacy. In traditional finance, benchmarks like the Dow Jones Industrial Average crossing 10,000 or gold surpassing $2,000/oz had profound effects on how those assets were perceived. Bitcoin holding six figures reshapes the narrative: it’s no longer “digital gold in the making” but arguably a fully established global store of value.

Moreover, the consistency matters just as much as the price. By staying above $100,000 for 122 consecutive days, Bitcoin demonstrates durability that silences critics who once dismissed it as a bubble. This level of stability reduces the perception of extreme risk and opens the doors for wider integration across finance.

The Institutional Factor

Perhaps the single biggest driver behind this sustained rally is institutional adoption. The approval and growth of spot Bitcoin ETFs in the U.S., Europe, and parts of Asia have transformed the liquidity profile of the market. Unlike retail-driven bull runs of the past, which were prone to panic selling, ETF flows are dominated by pension funds, endowments, and asset managers — investors with long-term horizons.

According to recent data, U.S.-listed spot Bitcoin ETFs now hold over 1.3 million BTC, representing more than 6% of total circulating supply. This creates structural demand that absorbs selling pressure and stabilizes prices. Major firms such as BlackRock, Fidelity, and Vanguard have not only launched products but also actively promoted Bitcoin allocation as part of diversified investment strategies.

For the first time in history, Bitcoin is being presented to average investors on Wall Street as a core portfolio holding, not a fringe alternative. That legitimization is the foundation for the current streak.

Macroeconomic Tailwinds

The macro backdrop has also played a critical role. Global inflation remains sticky despite central bank efforts to control it. Currency instability, especially in emerging markets, has further eroded confidence in fiat systems. Countries like Argentina, Turkey, and Nigeria are experiencing currency depreciation, prompting citizens and businesses to seek refuge in Bitcoin.

Even in developed economies, debt crises and fiscal concerns are fueling interest in hard assets. In the U.S., rising deficits and ballooning interest costs on government debt have sparked fears of long-term dollar weakness. Against this backdrop, Bitcoin is increasingly viewed as digital gold with a modern twist: portable, transparent, and globally accessible.

Network and Supply Dynamics

Bitcoin’s fundamentals reinforce the price story. The network’s hash rate — a measure of mining power securing the system — continues to hit record highs, reflecting confidence among miners despite reduced block rewards following the 2024 halving. This halving, which cut the reward from 6.25 to 3.125 BTC per block, has further tightened supply.

When combined with ETF demand and increased long-term holding behavior (as shown in on-chain metrics), Bitcoin’s supply shock is magnified. The result is a supply-demand imbalance that naturally pushes the floor price higher. The fact that Bitcoin has remained consistently above $100,000 highlights how scarcity economics are finally translating into sustained market behavior.

The Psychological Shift: From Speculation to Confidence

Perhaps the most important change is in investor psychology. In previous cycles, fear of missing out (FOMO) drove markets up, but fear of collapse quickly brought them down. Today, confidence is stronger. New investors entering at $100,000 are not expecting a quick flip — they are buying into a long-term narrative of Bitcoin as a hedge and an asset class.

This shift is visible in retail patterns as well. Data from exchanges shows fewer short-term trades and more long-term accumulation. Wallets holding BTC for over 12 months are at all-time highs, indicating strong conviction. This long-term mindset reduces volatility and strengthens price floors.

Global Impact on Finance

Bitcoin’s six-figure streak is reshaping global finance in several ways:

- Banks and Custody Services:

Major global banks such as JPMorgan, HSBC, and Deutsche Bank are rolling out Bitcoin custody solutions to meet institutional demand. This closes the gap between traditional finance and crypto. - Corporate Treasuries:

Corporations are again revisiting treasury strategies. Following the footsteps of MicroStrategy and Tesla in earlier cycles, more multinational companies are diversifying balance sheets with Bitcoin. - Government Involvement:

Several countries, including some in the Middle East and Asia, are openly exploring Bitcoin as part of their sovereign wealth fund strategies. While not official legal tender like El Salvador, Bitcoin is quietly entering the conversation at the highest policy levels. - Payments and Settlement:

Payment processors are now integrating Bitcoin rails into settlement systems. With stablecoins and Lightning Network adoption, cross-border settlement using BTC is becoming more efficient and widespread.

What Comes Next? Supercycle or Caution?

The big question is whether Bitcoin is entering a supercycle or simply consolidating before a correction.

- Supercycle View: Proponents argue that with institutional demand, ETF inflows, halving-driven scarcity, and global adoption, Bitcoin may no longer follow its historical boom-bust cycles. Instead, it could steadily climb toward $200,000 and beyond, establishing itself in the same category as gold or even surpassing it in total market capitalization.

- Caution View: Skeptics warn that extended bullish streaks often breed complacency. A macro shock, regulatory clampdown, or liquidity crisis could trigger corrections. However, even cautious analysts agree that a return below $50,000 is highly unlikely — the floor has shifted upwards.

The New Baseline

Bitcoin’s 122-day streak above $100,000 is not just about price — it is about perception. It cements Bitcoin’s place in the global financial system and signals a permanent shift in how it is valued. The days of Bitcoin being dismissed as a passing bubble are gone. Today, it is increasingly recognized as a foundational asset for the digital age.

Six figures is no longer a dream — it is the new baseline. The next frontier may be $150,000 or $200,000, but what matters most is that Bitcoin has matured into a resilient, globally accepted asset class. Whether you are an institutional investor, a retail participant, or a policymaker, the message is clear: Bitcoin is here to stay, and the era of six-figure stability has just begun.