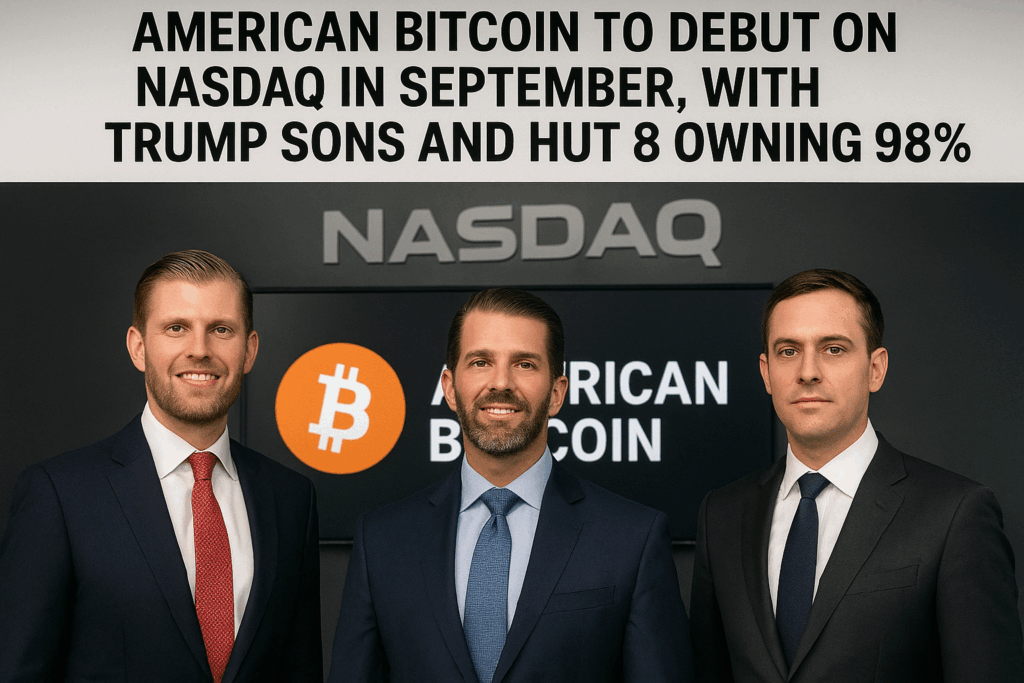

American Bitcoin, a Bitcoin mining and treasury company backed by Eric Trump, Donald Trump Jr., and Hut 8, is set to begin trading on the Nasdaq in early September under the ticker ABTC. The newly formed entity will be controlled almost entirely—98%—by the Trump brothers and Hut 8.

Key Highlights:

- Nasdaq Listing via Merger

Rather than pursuing a traditional IPO, American Bitcoin will go public through an all-stock merger with Nasdaq-listed Gryphon Digital Mining. The merger is expected to close soon, with trading slated to start in early September 2025 under the ticker ABTC. - Concentrated Ownership Structure

Following the merger, Hut 8—currently holding around 80% of American Bitcoin—together with Eric Trump and Donald Trump Jr., will collectively own 98% of the combined entity. - Strategic Rationale for the Merger

Hut 8 CEO Asher Genoot emphasized that the merger approach provides greater access to existing capital markets and financing channels, which American Bitcoin can leverage for growth. - Global Expansion Ambitions

American Bitcoin is actively exploring expansion into Asia. Eric Trump is currently in Hong Kong and will soon travel to Tokyo for meetings with Japanese bitcoin treasury firm Metaplanet. The company aims to acquire bitcoin-heavy assets or stakes in Hong Kong and Japan to broaden exposure for investors who face barriers to accessing Nasdaq-listed securities. - Business Model and Positioning

Launched in March 2025 as a joint venture between Hut 8 and American Data Centers (a subsidiary of Dominari Holdings), American Bitcoin combines bitcoin mining operations with strategic accumulation of BTC. The firm positions itself as a “bitcoin treasury company,” echoing the model popularized by MicroStrategy.

What It Means for Markets and Investors:

- High Equity Concentration

With 98% ownership by founding shareholders and backers, the free float (shares available to public investors) will be limited. This could lead to reduced liquidity and heightened volatility around any share unlocks or capital raises in the future. - Leveraging Political Influence

The Trump family’s involvement injects instant visibility and political resonance. Their brand may draw both media attention and investor interest, especially among those bullish on the intersection of politics and crypto. - Institutional Financing Edge

Hut 8’s infrastructure, capital markets ties, and deep-pocketed backing position American Bitcoin to scale more aggressively than many traditional crypto ventures. - Regulatory and Geopolitical Watchpoints

As American Bitcoin expands into Asia, regulatory oversight and cross-border crypto legal frameworks become critical factors for its strategy and investor risk assessment.

In summary, American Bitcoin’s upcoming Nasdaq debut marks a bold and highly concentrated play in the crypto-equity space. Backed by high-profile political figures and institutional mining infrastructure, it could emerge as a focal point for investors seeking regulated public exposure to bitcoin. Still, retail and institutional investors alike should proceed with caution given the high ownership concentration and the regulatory complexities inherent in cross-border crypto expansion.