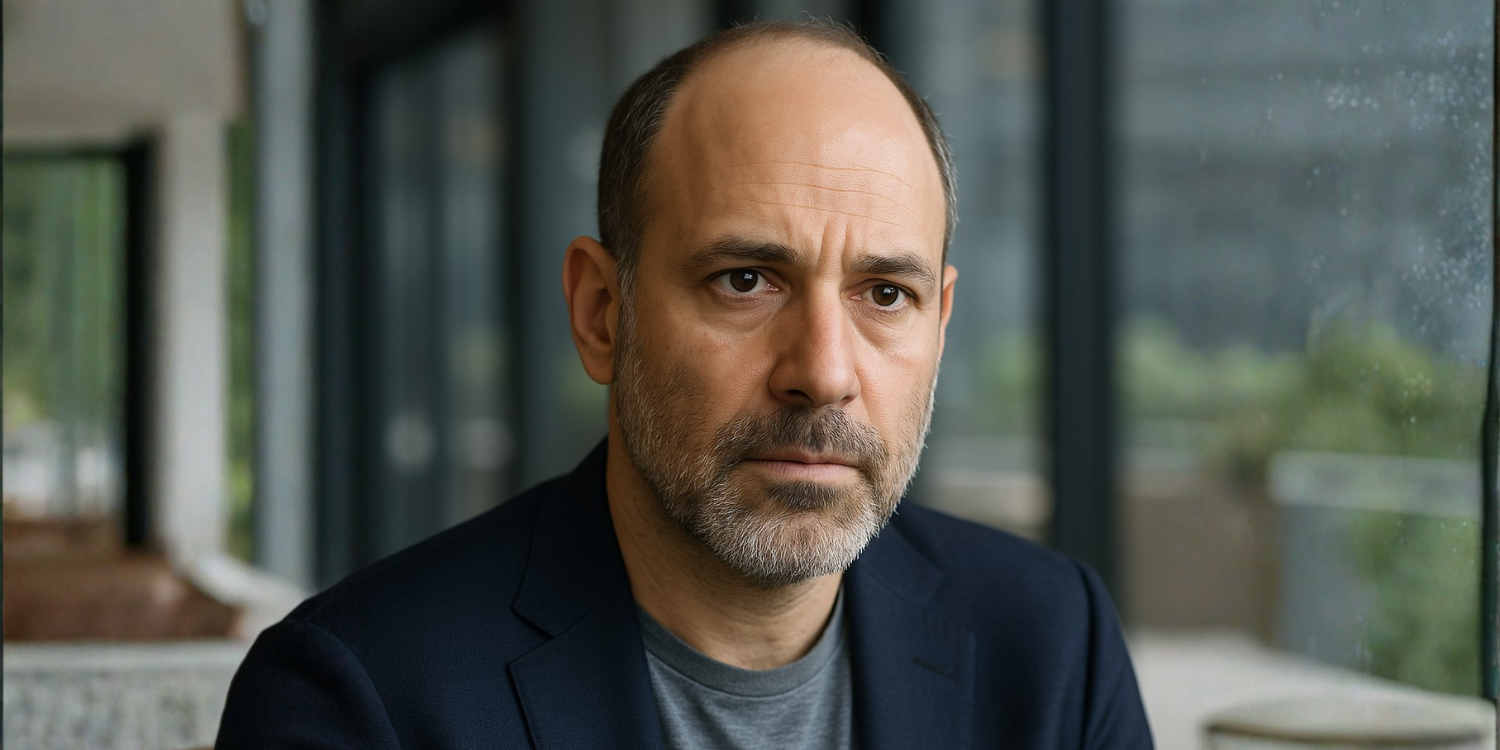

Eli Ben-Sasson, the CEO and co-founder of StarkWare Industries, recently sparked an important debate within the blockchain industry by declaring that corporate blockchains are destined to fail. His comments cut to the heart of a long-standing dilemma — whether private, company-controlled blockchains can ever deliver the true benefits that decentralization promises.

Ben-Sasson’s core argument is simple yet powerful: if a blockchain remains centralized under the control of a corporation, it loses its essence. The heavy infrastructure and complexity of blockchain technology make sense only when they replace the need for a trusted central authority. When that centralization remains, the blockchain becomes little more than a slower, more expensive version of traditional databases.

The Central Paradox: Blockchain vs. Corporate Control

The CEO’s statement underscores a deep philosophical and technical tension within the blockchain world. On one side are enterprises — banks, logistics giants, supply-chain firms, and tech conglomerates — that see blockchain as a way to streamline operations, share data more efficiently, or create tamper-proof systems within controlled networks. On the other side are Web3 purists, who believe blockchain’s very purpose is to dismantle centralized control and hand power back to users.

Ben-Sasson argues that when a company keeps full control of the network, the system stops being “trustless.” Instead, it turns into a distributed database — useful perhaps for coordination, but not revolutionary. True decentralization, he insists, is what gives blockchain its magic: resilience, censorship resistance, and fairness through code instead of authority.

He points out that blockchain technology inherently involves costs — computational overhead, redundancy, slower speeds — which only make sense if they deliver a benefit that centralized systems cannot. For corporate blockchains, those trade-offs often don’t add up.

Why This Matters to the Market

The remark comes at a critical time when corporations across sectors are re-evaluating their blockchain strategies. Over the last decade, numerous enterprises — from IBM and Maersk to major banks and consortiums — launched private blockchain projects, hoping to transform data management and transaction verification. Many of those experiments quietly stalled or were shelved when they failed to achieve meaningful adoption.

Ben-Sasson’s comments suggest why: users don’t rally around systems they can’t influence or verify. In the decentralized world, credibility comes from transparency and shared governance. A chain ruled by one corporation may be efficient in the short term, but it lacks the open participation that drives long-term network effects.

In financial markets, investors have also begun distinguishing between blockchain-based products that are open and public (like Ethereum, Solana, or Bitcoin Layer-2s) and private chains that mimic the structure of legacy IT systems. The former benefit from developer communities, user incentives, and global liquidity; the latter often depend on a handful of enterprise clients and internal partnerships.

The Technical Argument Behind the Statement

Ben-Sasson’s company, StarkWare, is a leading force in zero-knowledge proof technology, which underpins Ethereum Layer-2 solutions such as Starknet. His deep technical background gives weight to his criticism. According to him, blockchains are built for trust minimization — not for companies that already operate in trust-based environments.

When an enterprise builds a “permissioned” blockchain, it typically designates which entities can validate transactions. This reintroduces gatekeepers. It may enhance privacy or compliance, but it also undermines the open, verifiable nature of the ledger. Without decentralization, consensus loses its significance — and so does the justification for using blockchain at all.

In other words, blockchain without decentralization is like an airplane that never leaves the runway — technologically impressive, but failing to deliver its defining purpose.

Implications for Businesses and Developers

For enterprises experimenting with blockchain, Ben-Sasson’s words serve as a cautionary signal. The question is not simply “Can blockchain improve our systems?” but rather “Are we willing to share control?”

If the answer is no, companies might be better off sticking to centralized databases, which are cheaper, faster, and easier to maintain. But if the goal is to build trust across independent parties, then decentralization is essential. Businesses may need to rethink how they participate — possibly by leveraging public chains or Layer-2 solutions rather than building their own isolated ledgers.

For developers, the takeaway is equally clear. Public networks remain the most fertile ground for innovation. Open infrastructure allows for composability — where one project can build on another without permission. Corporate blockchains, by contrast, often close off this creative feedback loop.

Historical Lessons from Enterprise Blockchain Failures

The last decade offers ample examples supporting Ben-Sasson’s point. Projects like IBM’s Hyperledger Fabric, R3’s Corda, and the Maersk-IBM TradeLens initiative were once hailed as transformative. Yet many of these efforts either failed to scale or were eventually discontinued.

Why? Because while they improved record-keeping within specific business silos, they never attracted meaningful external participation. Without a public incentive structure — no miners, validators, or tokenized rewards — there was little reason for outsiders to contribute. The systems worked only so long as the initiating corporations stayed interested.

In contrast, public blockchains like Ethereum have continued to evolve through open governance and developer communities. Even amid bear markets, they thrive because no single entity controls their direction — the ecosystem sustains itself through shared ownership.

The Broader Reflection: Decentralization as Survival

Ben-Sasson’s prediction aligns with a larger truth in blockchain history — the long-term survivors are those that decentralize. Bitcoin survived government crackdowns and competition because no one could shut it down. Ethereum adapted through community consensus, not corporate decision-making. Decentralization, while messy and slower, ensures resilience and continuity.

Corporate chains, however, depend on budgets, leadership, and quarterly goals. If management changes or market priorities shift, those blockchains often vanish overnight. In an industry built on the promise of permanence and transparency, such dependence becomes a fatal flaw.

What Comes Next: Hybrid Futures and Layer-2 Paths

While Ben-Sasson’s view may sound absolute, the future might not be entirely binary. Some analysts believe hybrid models will emerge — systems that combine enterprise governance with open-source decentralization. For instance, corporations could build on Layer-2 networks that maintain transparency while offering scalability and privacy features.

Instead of owning the blockchain, companies would simply become participants — benefiting from shared infrastructure without monopolizing it. This model aligns with what many see as the next evolution of Web3: collaboration without control.

Final Thoughts

Eli Ben-Sasson’s statement that “corporate blockchains will fail” is not just a prediction; it’s a philosophical reminder. Blockchain was never meant to be a tool for reinforcing authority — it was designed to dissolve it. The technology only realizes its full potential when control is distributed, transparency is guaranteed, and participation is open.

Corporate blockchains may continue to exist as experiments or niche systems, but unless they embrace genuine decentralization, they are unlikely to shape the next era of digital trust. In the end, the market will likely reward open systems over controlled ones, just as the internet did decades ago.