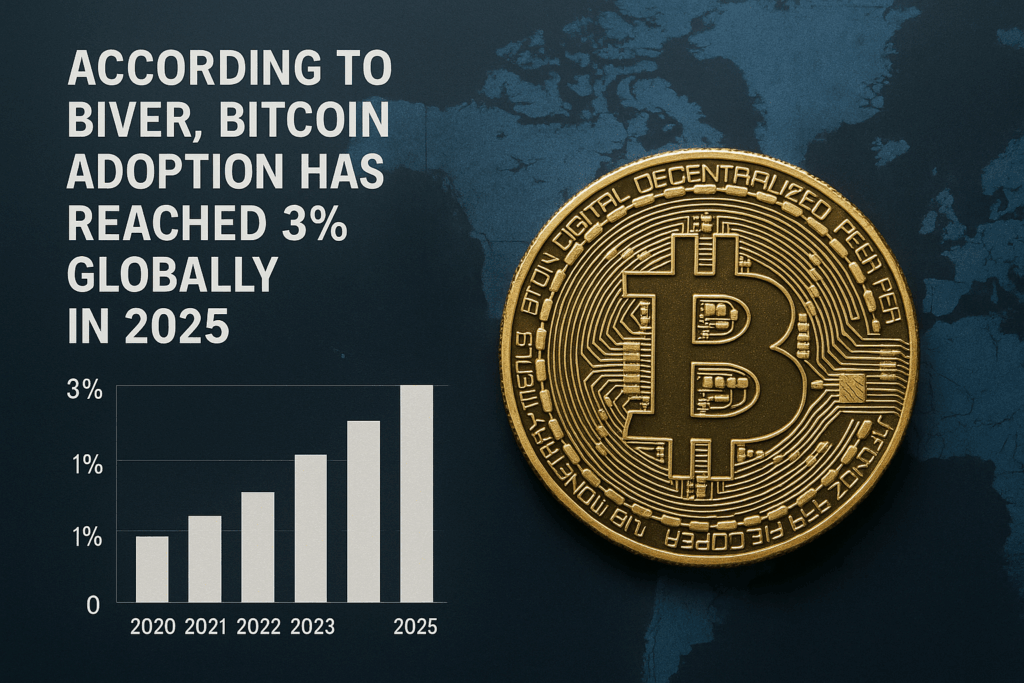

A new report from River Financial suggests that global adoption of Bitcoin (BTC) has reached approximately 3% of the world population in 2025. While adoption remains modest, this milestone indicates continued momentum in both retail and institutional uptake.

What Does the 3% Figure Mean?

- The ~3% metric refers to the portion of the global population that holds Bitcoin or has used it in some capacity.

- Importantly, River frames this as just a fraction of Bitcoin’s full adoption potential.

- In some commentary, it was noted that Bitcoin has reached only ~3% of its maximum adoption potential, a way to emphasize how early-stage the market remains.

Key Drivers of Growth

River’s report outlines several factors that are fueling this growth:

- Institutional and Corporate Inflows

- Business adoption has scaled significantly: River clients have added roughly 84,000 BTC in 2025.

- Many private firms are reinvesting a portion (~22%) of profits into Bitcoin.

- Sector-wise, real estate has been the most active (nearly 15% of firms reinvesting profits), followed by hospitality, finance, software, and others.

- Business inflows in the first eight months of 2025 already surpassed the total of the previous year by US$12.5 billion.

- Maturing Infrastructure & Custody Solutions

- Improved custody services, regulated compliance frameworks, and easier onramps for institutional investors are helping reduce friction.

- Upgrades in accounting standards and increased regulatory clarity are also cited as enabling factors.

- Lightning Network and Payment Layer Growth

- Continued development and adoption of second-layer scalability solutions (e.g., Lightning Network) are helping with usability, micropayments, and reducing transaction fees/time.

- As payment flows via Lightning increase, more users are likely to experiment with Bitcoin beyond just holding it.

- Rising Retail Awareness & Geographical Spread

- Awareness and use-cases are spreading beyond developed markets to emerging regions. Although adoption is uneven, countries with constrained banking infrastructure, high remittance flows, and inflationary pressures are seeing higher relative uptake.

Regional Adoption Trends & Gaps

While global adoption is trending upward, the distribution is uneven:

- North America remains ahead in terms of per-capita penetration, owing to better infrastructure, greater financial literacy, and more favorable regulation.

- Emerging markets show promise, but face barriers such as regulatory uncertainty, lack of user education, volatility concerns, and connectivity/infrastructure issues.

River’s report suggests that although 3% is a milestone, many regions are still underpenetrated, and meaningful growth will require overcoming structural frictions.

Implications & Outlook

- Upside Potential: Bitcoin is still considered early in its adoption lifecycle. The 3% figure can be viewed as a baseline from which further growth is likely, especially as infrastructure improves and regulatory clarity increases.

- Institutional Confidence: The inflows from firms reinvesting profits and building BTC reserves are signs of growing confidence in Bitcoin as a store of value or corporate treasury asset.

- Volatility & Education Risks: However, volatility remains a concern for many users. For wider adoption, improving user education, reducing onboarding friction, and better managing regulatory risk will be key.

- Competition and Diversification: As more payment rails, stablecoins, CBDCs, and alternate crypto solutions evolve, Bitcoin’s share of the new digital asset ecosystem could face headwinds unless it continues innovating on speed, cost, and usability.

- Future Growth Drivers: Continued improvements in custodial services, Lightning Network adoption, and integration with traditional financial rails will likely be the next phases of growth. Also, cross-border remittance use-cases and unbanked populations in emerging markets present significant upside.

Overall, the ~3% adoption figure from River is a sign that Bitcoin is gradually building traction, but still has a long runway to climb in terms of mainstream adoption.