Key Insight

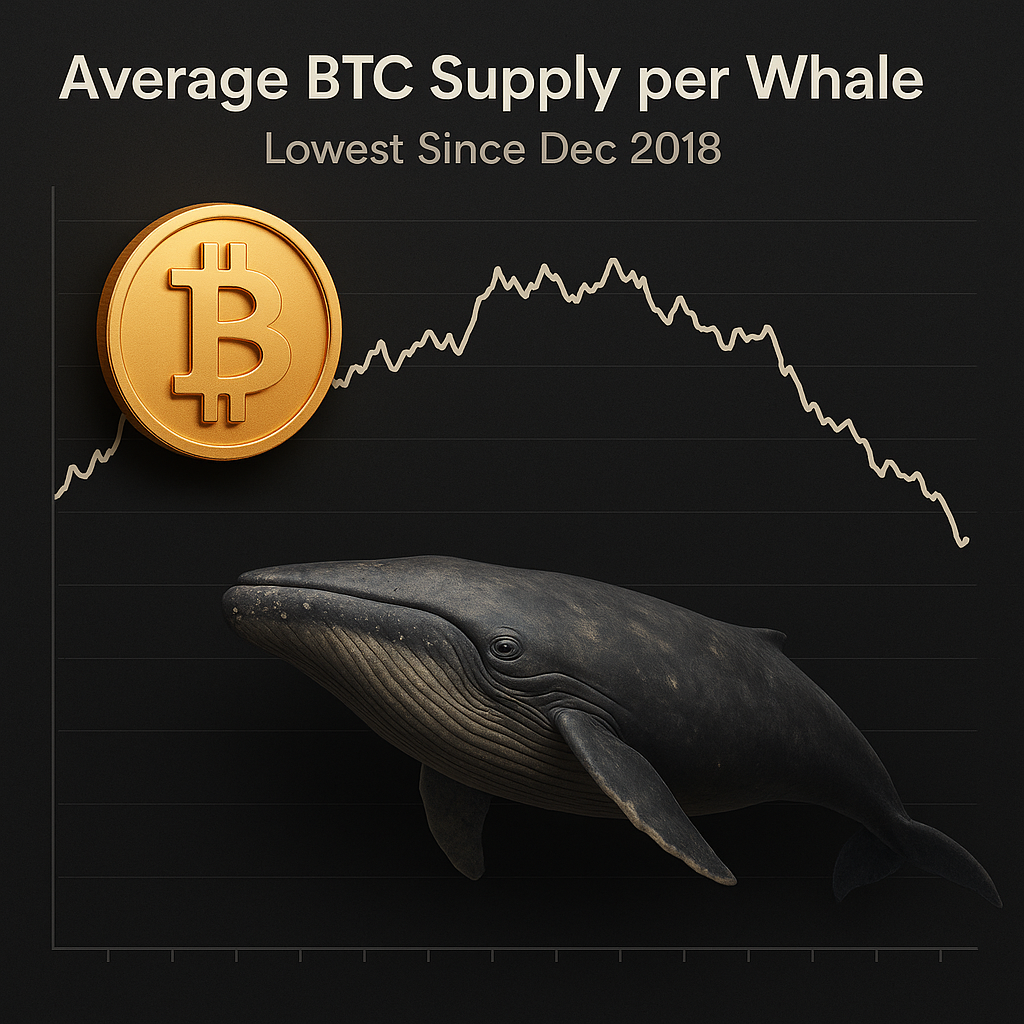

According to the latest on-chain data from analytics firm Glassnode, the average Bitcoin supply per whale—entities holding between 100 BTC and 10,000 BTC—has fallen to approximately 488 BTC. This marks the lowest level recorded since December 2018, highlighting a major structural shift in Bitcoin ownership distribution among large holders.

Why the Drop Is Significant

- Historical Trend:

During Bitcoin’s bull cycles of 2020–2021, whale entities steadily accumulated large positions, with average holdings peaking above 700 BTC at their strongest levels. However, since the market downturn in 2022 and the post-rally sell-offs of 2024, the average per-whale balance has gradually declined. The sharp drop to 488 BTC now represents a multi-year low not seen in nearly seven years. - Distribution of Supply:

This decline suggests that whales are reducing concentration of Bitcoin holdings, either by selling into strength during rallies or redistributing coins to smaller holders and institutional participants. The broader ownership base points toward growing retail and ETF-driven demand, rather than accumulation by traditional whale wallets. - Profit-Taking Dynamics:

The fall in average whale supply coincides with a period of heavy profit realization. Many large holders appear to have taken advantage of Bitcoin’s rallies in late 2024 and early 2025 to secure gains, lowering their exposure as markets faced volatility.

Market Implications

1. Potential Bearish Pressure

Large holders often act as market stabilizers during accumulation phases. A reduction in whale positions can imply weaker buy-side support in the near term, raising the risk of sharper corrections if retail demand fails to absorb selling pressure.

2. Shifts in Market Liquidity

When whales sell or redistribute holdings, those coins typically move into more active circulation. This can increase liquidity in the market, heightening volatility. While liquidity boosts price discovery, it also means faster swings in both directions.

3. Healthy Long-Term Distribution

On the positive side, a decline in whale dominance signals greater decentralization. Broader distribution of BTC across a wider investor base—especially with ETF inflows and institutional custodianship rising—may reduce systemic risks tied to a few large players controlling vast supplies.

4. Cyclical Pattern Suggestion

Historically, sharp drops in whale balances have often preceded new accumulation cycles. For example, in late 2018, whale balances fell significantly before staging a strong rebound during the 2019–2020 uptrend. This suggests that current reductions may not signal abandonment but rather rebalancing before the next phase of accumulation.

Wider Context

- ETF and Institutional Impact:

With the approval of spot Bitcoin ETFs in multiple jurisdictions, significant BTC demand has shifted from whale entities to regulated funds. These ETFs provide exposure without requiring investors to hold coins directly, thereby redistributing supply away from whale wallets into custodial institutions. - Retail and Mid-Tier Holder Growth:

On-chain metrics also indicate rising activity among “shrimps” (holders of less than 1 BTC) and “crabs” (1–10 BTC), as these smaller investors accumulate at faster rates. This signals a democratization of supply and increasing grassroots participation in the Bitcoin ecosystem. - Comparison to 2018 Levels:

The last time whale supply averages were this low, Bitcoin was consolidating after its first major bull run in 2017. The subsequent years saw gradual re-accumulation and a powerful rally in 2020–2021. Many analysts view the current data point as echoing that earlier market structure, potentially laying groundwork for the next long-term bull cycle.

Summary

The average Bitcoin supply per whale has dropped to 488 BTC, the lowest level since December 2018. While this reflects large-scale profit-taking and redistribution by whales, it also signals a healthier, more decentralized distribution of Bitcoin ownership across retail and institutional participants.

In the short term, reduced whale dominance could mean higher volatility and weaker buy-side support, but in the long term, this structural shift may set the stage for broader adoption and more resilient price growth.