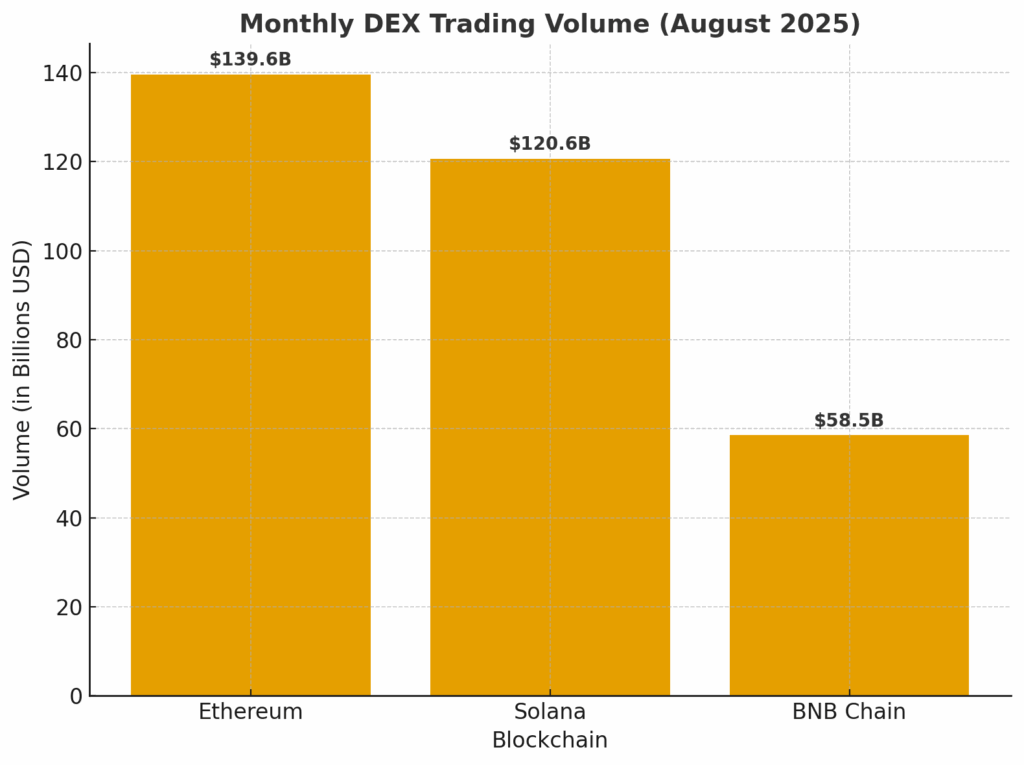

Ethereum’s decentralized finance (DeFi) ecosystem just reached a historic milestone, recording an all-time high of $139.6 billion in monthly DEX (Decentralized Exchange) trading volume in August 2025. This new record not only cements Ethereum’s dominance but also widens the gap between its rivals — Solana at $120.6 billion and Binance Smart Chain (BNB Chain) at $58.5 billion.

The Driving Forces Behind Ethereum’s Surge

- Layer-2 Networks as Growth Engines

Much of Ethereum’s recent success comes from its rapidly growing Layer-2 networks, which are designed to scale the main Ethereum chain while reducing transaction fees. Key players include:- Base (Coinbase’s L2): Recorded a massive $53 billion in monthly volume.

- Arbitrum: Brought in $24.8 billion, highlighting its strong DeFi ecosystem.

- Polygon: Contributed $15.9 billion, maintaining steady traction with both DeFi and gaming/NFT use cases.

Together, these networks accounted for a substantial portion of Ethereum’s record volumes, proving that Ethereum’s scalability roadmap is working in practice.

- Network Upgrades Boosting Efficiency

The rollout of major upgrades such as Dencun (which introduced “blob transactions” to lower data costs) and preparation for Pectra have made DeFi transactions faster and cheaper, improving user experience and attracting greater trading activity. - Institutional Capital Flowing In

The approval and success of Ethereum spot ETFs have injected fresh capital and legitimacy into the network. This has encouraged institutional players to allocate more liquidity to Ethereum-based DeFi platforms, further fueling DEX activity. - Liquidity Depth and Ecosystem Resilience

Ethereum continues to be the home for major DEX protocols like Uniswap, Curve, and Balancer, which offer unparalleled liquidity pools. Combined with staking services and yield opportunities, Ethereum’s infrastructure remains unmatched in depth and reliability compared to competitors.

Comparison with Competitors

- Solana ($120.6B):

Solana remains Ethereum’s closest rival in the DeFi race, boosted by its high-speed, low-cost transaction architecture. However, Solana’s ecosystem has faced network reliability challenges in the past, making Ethereum’s higher security and maturity more appealing for large-scale institutional trading. - BNB Chain ($58.5B):

While BNB Chain continues to serve as a gateway for retail traders, especially in Asia, its monthly DEX volumes remain less than half of Ethereum’s. Concerns over centralization and tighter regulatory pressure on Binance have also weighed on activity.

Why This Matters for the Market

- Ethereum’s Unshakable DeFi Dominance

This milestone reaffirms Ethereum as the undisputed leader in DeFi. Despite years of competition from newer blockchains, Ethereum’s combination of liquidity, security, and developer activity remains unrivaled. - Layer-2 Adoption = Sustainable Growth

Instead of cannibalizing Ethereum, Layer-2 solutions are adding exponential scalability. Their rapid adoption shows that Ethereum can handle surging demand without clogging the main chain, a crucial advantage for future growth. - DEX Volumes as a Market Confidence Indicator

High trading activity on decentralized exchanges indicates strong investor confidence in on-chain trading, self-custody, and DeFi protocols. This is especially important in the post-FTX era, where centralized exchange trust remains under scrutiny. - Institutional Participation in DeFi

The increasing presence of ETFs, banks, and hedge funds on Ethereum-backed protocols suggests that institutional money is no longer just dipping its toes into crypto — it’s actively shaping the liquidity landscape.

Looking Ahead

If Ethereum maintains this pace, it could surpass $1.5 trillion in annualized DEX trading volume in 2025, a figure that rivals traditional equities markets for niche categories. With ongoing upgrades, greater integration of AI-powered trading tools, and cross-chain interoperability solutions in development, Ethereum is poised to extend its lead in the decentralized trading space.

Meanwhile, Solana and BNB will likely remain competitive but may need to innovate faster to catch up with Ethereum’s layered growth strategy.

Summary

Ethereum’s $139.6 billion DEX trading volume in August 2025 is a landmark moment for DeFi, outstripping Solana and BNB by wide margins. Powered by Layer-2 growth, network upgrades, and institutional inflows, Ethereum is not only holding its dominance but expanding it. This milestone underscores Ethereum’s role as the beating heart of decentralized finance — with scalability and innovation fueling its next phase of growth.