Email :110

Key Insight:

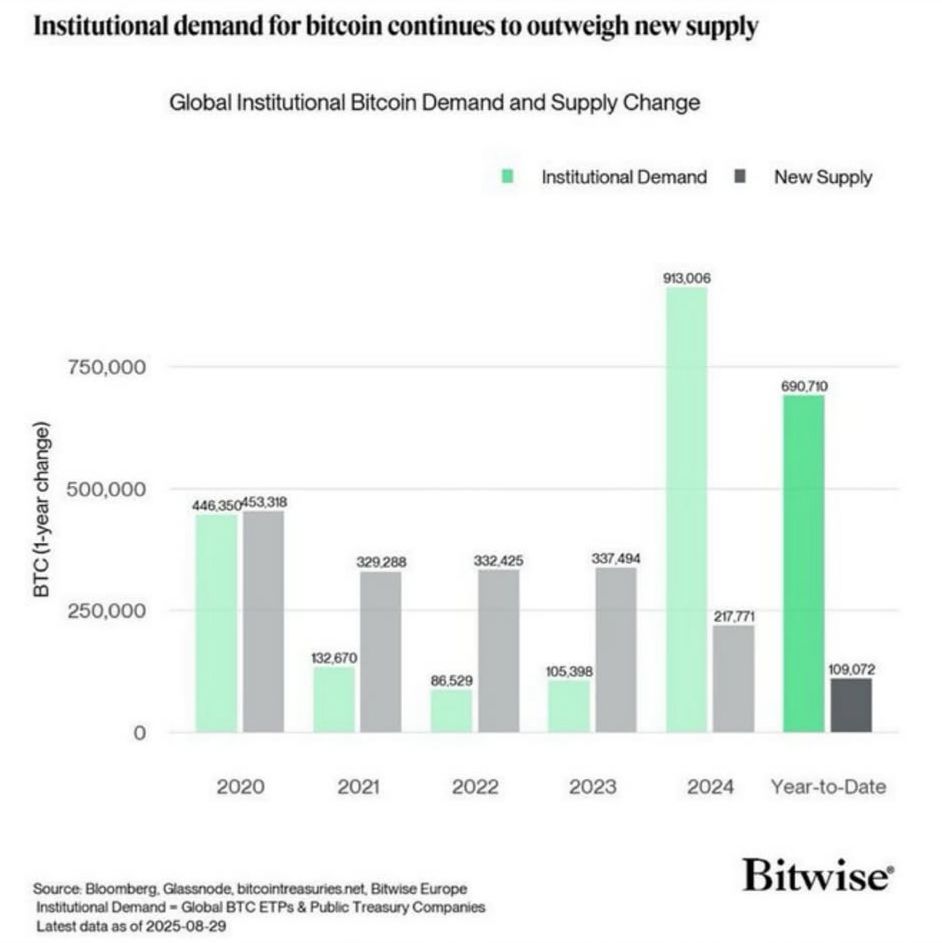

Institutional appetite for Bitcoin is smashing past new supply—now estimated at nearly 7 times greater than miner production—even though only a little over half of 2025 has passed.

The Numbers at a Glance:

- On Coinbase, institutional demand recently reached 600% of daily miner production—meaning institutions are buying six times more Bitcoin than is being minted.

- Other reports suggest institutional buying is even higher, with estimates placing demand at nearly 7× the newly mined supply.

What’s Fueling This Demand Surge?

- Spot Bitcoin ETFs are pouring in institutional capital. These funds consistently generate billions in daily volume, with U.S. ETFs handling up to $5–10 billion on active days.

- Companies and public treasuries are increasingly adopting Bitcoin. Public holdings now exceed 1.2 million BTC, with major players like MicroStrategy holding nearly 3% of total supply.

- Beyond ETFs, many U.S.-based firms are building “crypto treasury” models—accumulating large Bitcoin reserves, compounding demand further.

Implications for Bitcoin Markets:

- Scarcity Intensifies: When demand outstrips inflows from mining, markets naturally lean bullish. This imbalance may help explain Bitcoin’s rally toward new all-time highs above $120,000.

- Reduced Sell Pressure: As institutions favor long-term holding—particularly via treasuries and custody services—available coins on exchanges dwindle, tightening liquidity.

- Potential Price Acceleration: With tight supply and strong institutional conviction, Bitcoin may be poised for further upside, particularly if macro tailwinds like Fed policy continue to be supportive.

Summary:

Institutions are buying Bitcoin at a rate nearly seven times faster than new supply is created. Spot ETFs and corporate treasuries are the main demand drivers. This intense demand—amid shrinking liquidity—could fuel a major sustained bull phase in the months ahead.